Child Tax Credit 2024 Increase Income

Child Tax Credit 2024 Increase Income – The child you’re claiming the credit for was under the age of 17 on Dec. 31, 2023. which helped drive child poverty to a record low Jan. 29 According to a Washington Post report . Property Tax Rebate the additional child tax credit (ACTC). Families who are low-income or who, for some reason, had no income in the tax year 2023 may feel hard-pressed by not being able to .

Child Tax Credit 2024 Increase Income

Source : itep.org

Policy Basics: The Earned Income Tax Credit | Center on Budget and

Source : www.cbpp.org

Expanding the Child Tax Credit Would Help Nearly 60 Million Kids

Source : itep.org

Child Tax Credit Definition: How It Works and How to Claim It

Source : www.investopedia.com

Your First Look At 2024 Tax Rates: Projected Brackets, Standard

Source : www.forbes.com

Child Tax Credit: Income Limits for Eligibility Increased The Hype

Source : www.thehypemagazine.com

Your First Look At 2024 Tax Rates: Projected Brackets, Standard

Source : www.forbes.com

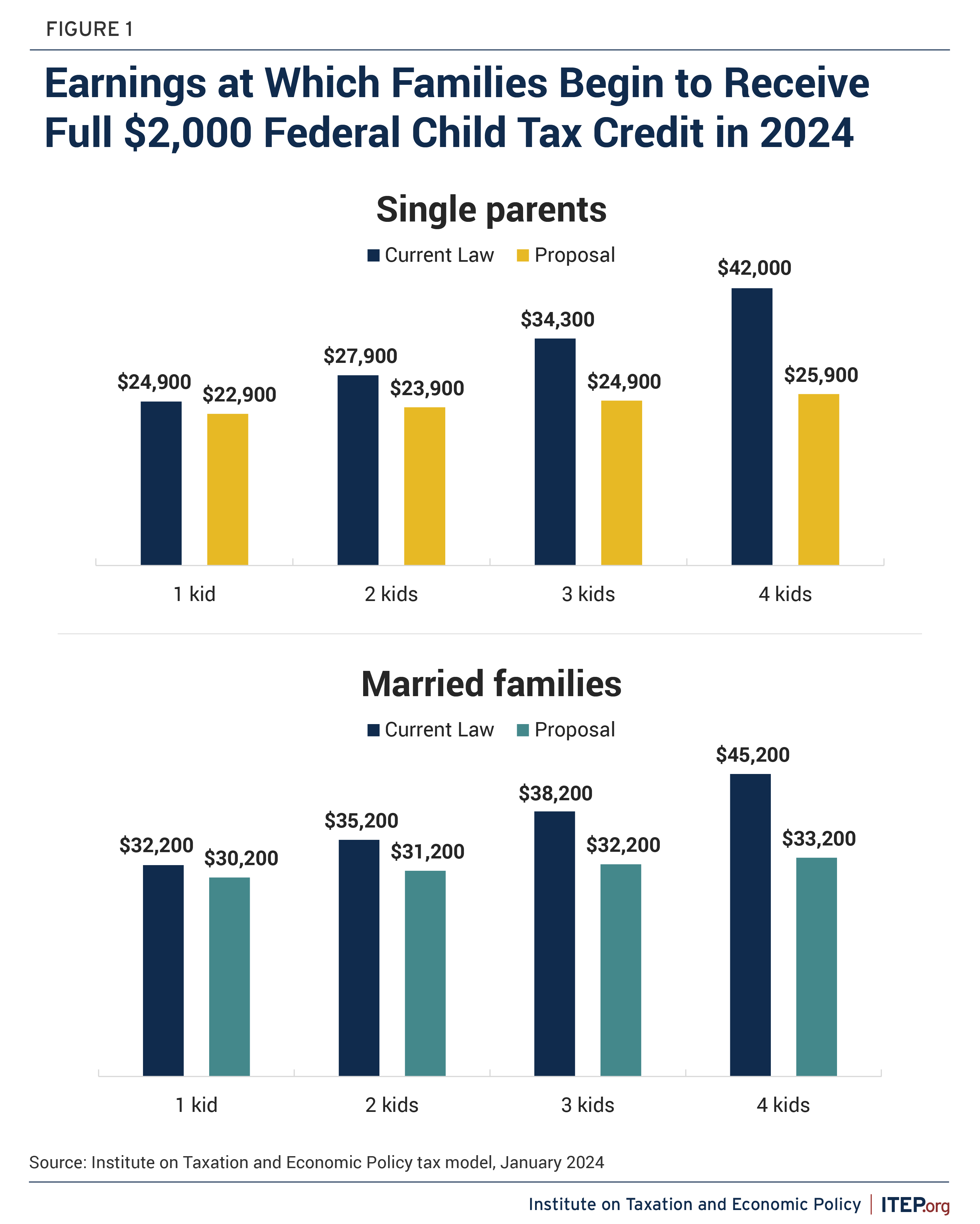

Proposed Tax Deal Would Help Millions of Kids with Child Tax

Source : itep.org

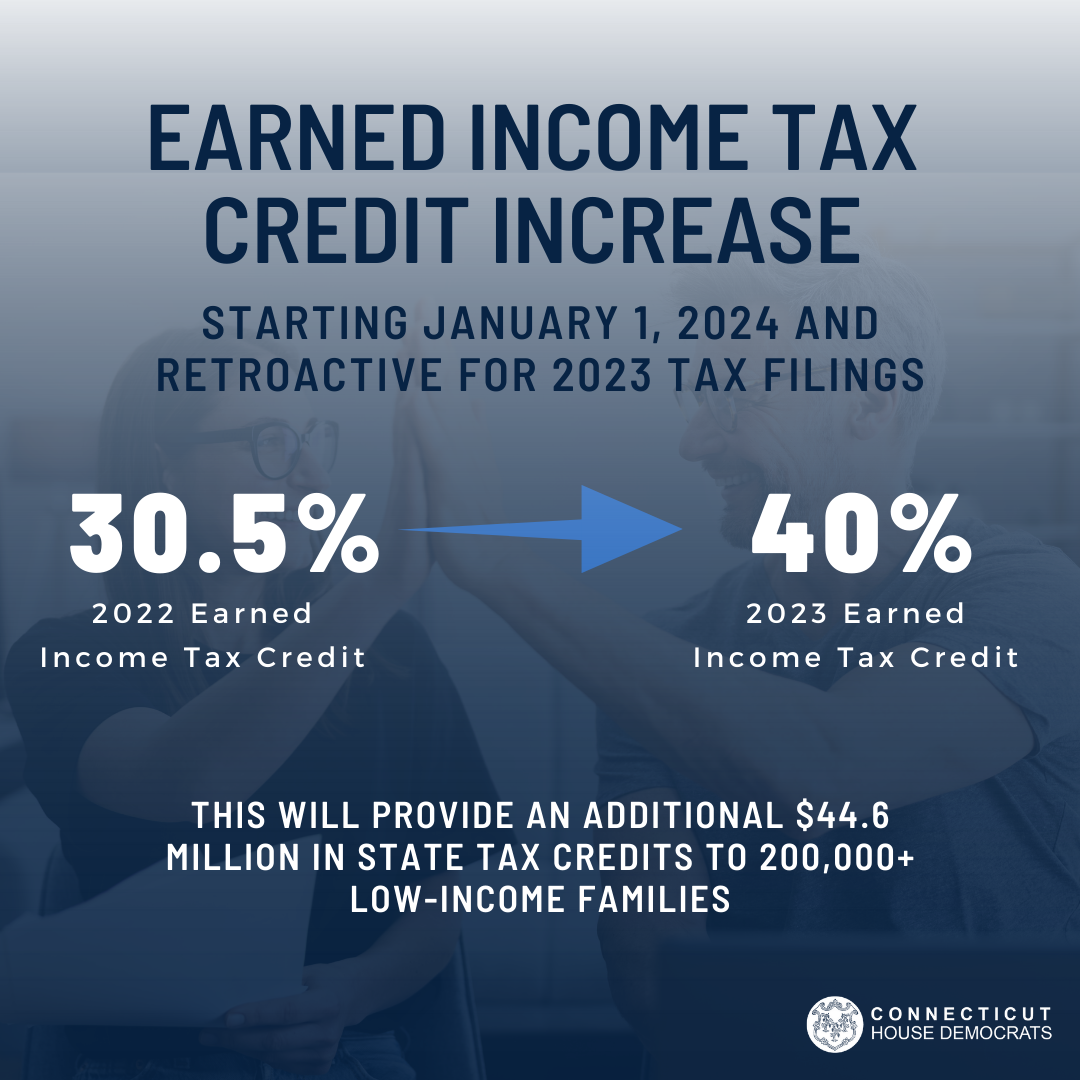

CT House Democrats on X: “CT’s #EITC for low income workers

Source : twitter.com

Historic Tax Cuts | Connecticut House Democrats

Source : www.housedems.ct.gov

Child Tax Credit 2024 Increase Income Expanding the Child Tax Credit Would Help Nearly 60 Million Kids : The framework suggests increasing the plan makes to the Low-Income Housing Tax Credit will build more than 200,000 new affordable housing units.” The changes also include adjusting the credit for . A deal between two influential politicians — a Democrat and a Republican — could have ramifications in this year’s tax season. .

:max_bytes(150000):strip_icc()/child-tax-credit-4199453-1-7dd01914195e4ab2bc05ae78a40f8f0c.jpg)